INTERNACIONAL

Future of Trump budget bill uncertain as House GOP rebels mutiny over Senate plan

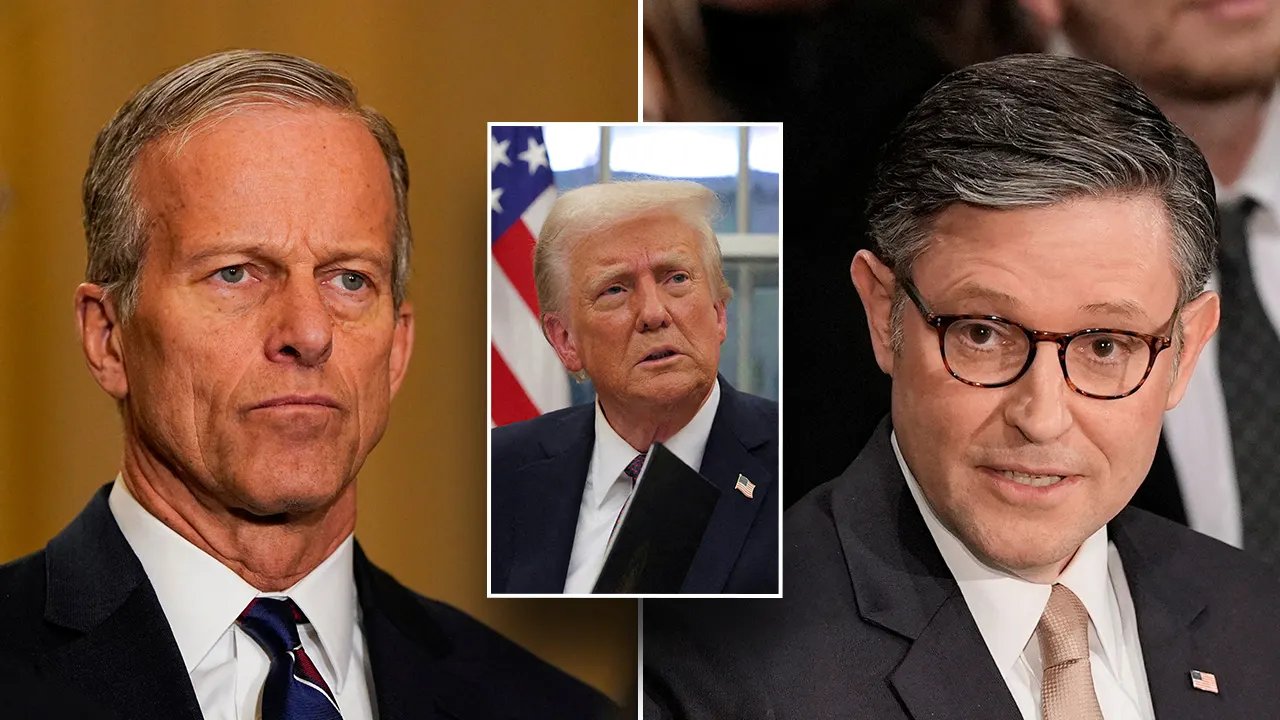

House Republicans are divided over how to proceed on a massive piece of legislation aimed at advancing President Donald Trump’s agenda as a possible vote on the measure looms Wednesday afternoon.

Fiscal hawks are rebelling against GOP leaders over plans to pass the Senate’s version of a sweeping framework that sets the stage for a Trump policy overhaul on the border, energy, defense and taxes.

Their main concern has been the difference between the Senate and House’s required spending cuts, which conservatives want to offset the cost of the new policies and as an attempt to reduce the national deficit. The Senate’s plan calls for a minimum of $4 billion in cuts, while the House’s floor is much higher at $1.5 trillion.

«The problem is, I think a lot of people don’t trust the Senate and what their intentions are, and that they’ll mislead the president and that we won’t get done what we need to get done,» Rep. Rich McCormick, R-Ga., told reporters on Tuesday. «I’m a ‘no’ until we figure out how to get enough votes to pass it.»

SENATE GOP PUSHES TRUMP BUDGET FRAMEWORK THROUGH AFTER MARATHON VOTE SERIES

Republicans aren’t necessarily on the same page just yet about budget reconciliation. (Reuters)

McCormick said there were as many as 40 GOP lawmakers who were undecided or opposed to the measure.

A meeting with a select group of holdouts at the White House on Tuesday appeared to budge a few people, but many conservatives signaled they were largely unmoved.

«I wouldn’t put it on the floor,» Rep. Chip Roy, R-Texas, told reporters after the White House meeting. «I’ve got a bill in front of me, and it’s a budget, and that budget, in my opinion, will increase the deficit, and I didn’t come here to do that.»

Senate GOP leaders praised the bill as a victory for Trump’s agenda when it passed the upper chamber in the early hours of Saturday morning.

Trump urged all House Republicans to support it in a Truth Social post on Monday evening.

Meanwhile, House Republican leaders like Speaker Mike Johnson, R-La., have appealed to conservatives by arguing that passing the Senate version does not in any way impede the House from moving ahead with its steeper cuts.

The House passed its framework in late February.

Rep. Chip Roy, R-Texas, who was at the White House meeting on Tuesday afternoon, is still skeptical about the Senate plan. (Kevin Dietsch/Getty Images)

Congressional Republicans are working on a massive piece of legislation that Trump has dubbed «one big, beautiful bill» to advance his agenda on border security, defense, energy and taxes.

Such a measure is largely only possible via the budget reconciliation process. Traditionally used when one party controls all three branches of government, reconciliation lowers the Senate’s threshold for passage of certain fiscal measures from 60 votes to 51. As a result, it has been used to pass broad policy changes in one or two massive pieces of legislation.

Passing frameworks in the House and Senate, which largely only include numbers indicating increases or decreases in funding, allows each chamber’s committees to then craft policy in line with those numbers under their specific jurisdictions.

MEET THE TRUMP-PICKED LAWMAKERS GIVING SPEAKER JOHNSON A FULL HOUSE GOP CONFERENCE

Members of the conservative House Freedom Caucus have pushed for Johnson to allow the House GOP to simply begin crafting its bill without passing the Senate version, though both chambers will need to eventually pass identical bills to send to Trump’s desk.

«Trump wants to reduce the interest rates. Trump wants to lower the deficits. The only way to accomplish those is to reduce spending. And $4 billion is not – that’s … anemic. That is really a joke,» Rep. Eric Burlison, R-Mo., told reporters.

He said «there’s no way» the legislation would pass the House this week.

The measure will likely go through the House Rules Committee, which acts as the final gatekeeper for most legislation getting a chamber-wide vote.

Rep. Eric Burlison, R-Mo., who was not at the White House meeting, is also skeptical of the Senate plan. (Bill Clark/CQ-Roll Call via Getty Images)

However, tentative plans for a late-afternoon House Rules Committee meeting on the framework, which would have set up a Wednesday vote, were scrapped by early evening on Tuesday.

CLICK HERE TO GET THE FOX NEWS APP

The legislation could still get a House-wide vote late on Wednesday if the committee meets in the morning.

As for the House speaker, he was optimistic returning from the White House meeting on Tuesday afternoon.

«Great meeting. The president was very helpful and engaged, and we had a lot of members whose questions were answered,» Johnson told reporters. «I think we’ll be moving forward this week.»

Fox News’ Ryan Schmelz and Aishah Hasnie contributed to this report.

House Of Representatives,Republicans,House Budget,Donald Trump

INTERNACIONAL

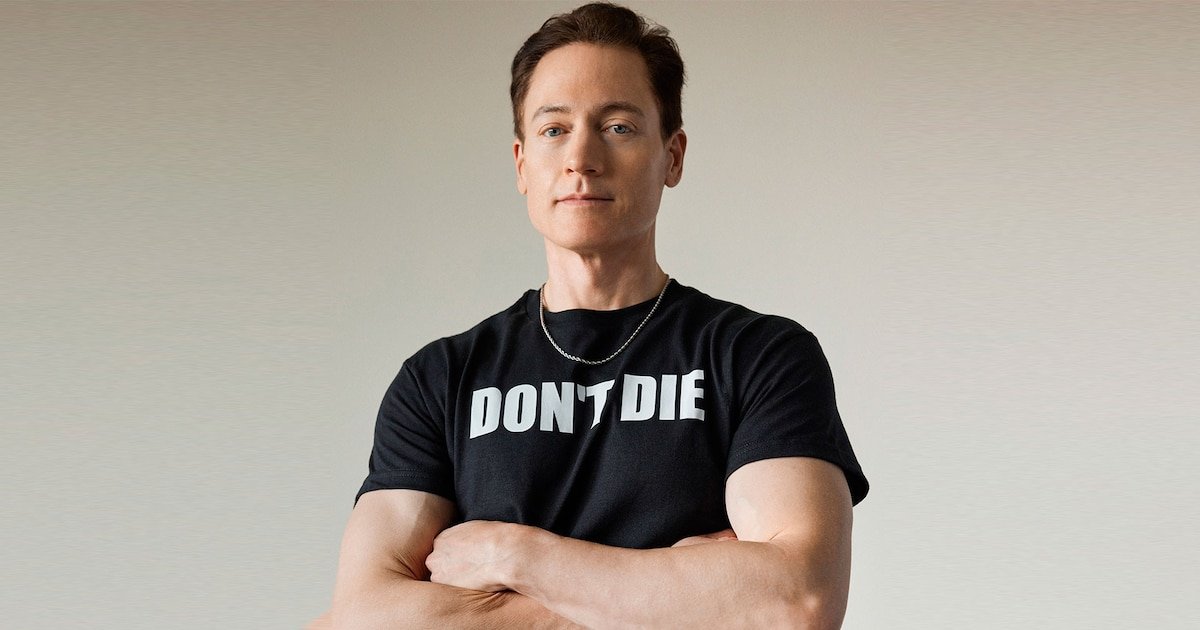

“No estoy defendiendo la inmortalidad, solo que elijamos no morir”: Bryan Johnson habló sobre longevidad, IA y la revolución del Project Blueprint

Hace algunos años, Bryan Johnson saltó a la fama mundial como el multimillonario de la longevidad, pero su historia y ambiciones revelan mucho más que rituales y comportamientos llamativos. La iniciativa Project Blueprint, que lidera desde California, es tanto experimento personal como empresa biotecnológica: une inteligencia artificial, cuantificación exhaustiva y sistematización para desafiar los límites del envejecimiento humano.

Johnson cree que la clave para prolongar la existencia reside en la automatización estricta de la rutina, complementada por tecnología de punta y una filosofía centrada en la supervivencia.

Su residencia en Venice, California, se asemeja a un laboratorio, donde ningún detalle queda al azar: desde la comida y los suplementos hasta la recolección y almacenamiento de muestras biológicas, toda variable se encuentra bajo control.

Johnson somete su cuerpo a un régimen tan meticuloso como exhaustivo: su día inicia antes del amanecer con exposición a luz de 10.000 lux, control de temperatura, aplicación de sueros, ejercicio, terapia de luz roja, oxigenación, sauna y múltiples pruebas médicas. La dieta es exclusivamente vegetal, restringida a la mañana y antes del mediodía, e incluye decenas de suplementos para optimizar métricas que él considera clave.

En tanto, desde 2021, la estrategia de Blueprint incluye alimentar una inteligencia artificial —Bryan AI— con todos sus datos y declaraciones, con el objetivo de perfeccionar su régimen y avanzar hacia la potencial transferencia de conciencia a sistemas computacionales.

La visión de Johnson trasciende la salud personal: postula que la supervivencia debe ser el nuevo eje ético, capaz de suplantar la búsqueda de riqueza y estatus en el mundo contemporáneo.

En búsqueda de más información, el equipo de Wired visitó el peculiar hogar del millonario. A cada paso, notó detalles tan pulidos como los fruteros repletos de kiwis y plátanos, y al mismo tiempo tan imperfectos como una naranja mohosa, “algo, al parecer, huele mal en la finca de Johnson”, afirmaron.

Un dilema que, en palabras de quienes transitaron por este lugar, materializa un contraste y dilema de este personaje: Johnson construye un entorno artificial casi perfecto, pero choca de frente con los límites y “fallos” de la condición humana.

Durante la conversación, Johnson explica con detalle su rutina nocturna: “He construido toda mi existencia en torno al sueño”, afirma y deja en claro que el descanso no es solo una necesidad biológica, sino el pilar central de su estrategia de longevidad. “Mi perfil de sueño es el de alguien de veintitantos años: duermo ocho horas y 34 minutos, me levanto menos de una vez por noche, y tengo un 94 % de eficiencia”, detalla.

Su jornada, dice, empieza la noche anterior: se acuesta con precisión quirúrgica, se duerme en minutos y se despierta antes del amanecer, exponiéndose a luz intensa y midiendo parámetros como la temperatura basal, que en su caso ha descendido más de dos grados: “Hay pruebas de que las especies con temperaturas más bajas viven más”, afirma.

Cuando se le plantea, de manera directa, si alguna vez morirá —una pregunta que más parece filosófica que biológica—, Johnson responde sin titubeos: “Falso”, ya que todos sus datos y discursos ahora se encuentran dentro inteligencia artificial personalizada.

“Actualmente, de forma muy rudimentaria, tengo una IA de Bryan que ha asimilado todo lo que he dicho”, un cambio que, según afirma, redefine el valor de seguir vivo: “A medida que la tecnología mejora, el bien más preciado será la existencia; la inmortalidad, tal como la concebíamos antes, a través de los logros, la descendencia o la vida después de la muerte, se devaluará en comparación con la existencia. Esa es mi apuesta fundamental para el futuro”.

Como figura pública obsesionada con la longevidad, Johnson no ha escapado a las críticas. Algunas figuras han señalado que su nivel de control podría rozar comportamientos obsesivos o incluso patológicos.

Es más, durante la entrevista, se comparó su comportamiento con patrones de un trastorno de la conducta alimentaria (TCA), una afirmación que Johnson no evade: “La mayoría de la gente que conozco en Estados Unidos tiene un trastorno alimentario. Claramente, luché con el control de mi ingesta de alimentos”.

Defiende su enfoque como una estrategia racional frente a un entorno saturado de estímulos adictivos. “¿Por qué iba a luchar contra decisiones cotidianas, diversas y, en última instancia, irrelevantes, cuando pueden automatizarse? Prefiero dedicar mi escasa capacidad cerebral a pensar en cosas de mayor nivel, como el futuro de la raza humana”, sostiene.

La automatización —para Johnson— es una estrategia de autonomía frente a un entorno saturado de algoritmos que incentivan el consumo y las adicciones. Su objetivo es crear un entorno de máxima libertad personal, donde las decisiones menores están automatizadas y controladas por datos; solo así puede concentrar energía intelectual en desafíos trascendentes.

En la entrevista, Johnson deja en claro que su cruzada trasciende el negocio o la autoexperimentación. Proclama la necesidad de una nueva ideología global: “La nueva respuesta a la existencia es que la existencia misma es la virtud suprema. No estoy defendiendo la inmortalidad ni la utopía. Solo digo que elijamos no morir”, afirma.

Con esta premisa, busca reemplazar antiguos sistemas de creencias y paradigmas políticos con una suerte de “religión” centrada en la supervivencia —individual y colectiva—, capaz de alinear tanto a humanos como a algoritmos bajo el principio Don’t Die.

Johnson reconoce que la fama no es un efecto colateral, sino un instrumento: “Si tuviera que elegir entre la fama y mil millones de dólares, la elegiría cien veces. Es muy difícil de conseguir. Tiene un valor excepcional”. Según él, solo con ese alcance es posible impulsar la ideología “de mayor crecimiento en la historia” y guiar la transición de la especie hacia una nueva etapa evolutiva.

Cree, en definitiva, que “algo surgirá y llenará este vacío, ya sea ‘No Mueras’ o algo más”. Su ambición no es solo extender la vida, sino fundar un nuevo marco de sentido que le dé respuesta —en términos prácticos y éticos— a los grandes dilemas del siglo XXI: la conciencia, la muerte y el futuro de la humanidad frente a la inteligencia artificial. Es que, en última instancia, espera que el legado de su experimento no se mida solo en métricas de salud o tecnología.

El ascenso de Johnson no estuvo exento de conflictos. Enfrentó disputas legales con su expareja Taryn Southern y varios exempleados, cuestionamientos por el uso extensivo de acuerdos de confidencialidad y reportajes que pusieron en duda la integridad de sus productos y la estabilidad financiera de su empresa. Pero, independientemente del futuro comercial de Blueprint, Johnson insiste en que su propósito real trasciende lo económico.

Su empeño está en sostener una visión filosófica y radicalmente transparente sobre la existencia: “Quiero que, en el siglo 25, digan que fue entonces cuando la humanidad descubrió que era la primera generación que no moriría”, afirma.

Lo que propone es un desplazamiento de las prioridades humanas: “Ahora mismo, lo único que tenemos en común es que nadie quiere morir”. En su visión, la inteligencia artificial no es solo una tecnología, sino un punto de inflexión que obliga a repensar cómo vivimos y decidimos. “Cuando surgen tecnologías transformadoras, necesitamos nuevas ideologías que nos ayuden a tomar decisiones cotidianas. Hoy no existe ninguna”, advierte.

Por eso concibe su cruzada como algo más que biotecnología o disciplina física: se trata de diseñar un nuevo marco de sentido frente al cambio irreversible: “No estoy defendiendo la inmortalidad. Solo estoy diciendo que elijamos no morir”, concluye.

bryan johnson

INTERNACIONAL

Unearthed Mamdani clip reveals how his upbringing made him open to being called ‘radical,’ socialist

NEWYou can now listen to Fox News articles!

A resurfaced interview by New York City socialist mayoral candidate Zohran Mamdani shows him explaining that the family he grew up in made him «open» to being a «radical» and suggesting that socialism needs to be re-branded.

«I think, honestly, growing up in the family that I grew up in, I was quite open to what would be considered being a radical from a very young age,» Mamdani said on The Far Left Show in 2020.

«I mean, from the beginning, my identities are already considered radical by a lot of mainstream American political thought. So being a Muslim, being an immigrant, these are things that already kind of put you in the box of ‘other.’ And so it’s not that far of a jump because whenever you… stand up to speak up for the rights of others who share the same identity as you, then you’re a radical, right? So often people in this country are considered radicals if they stand up for Palestinian human rights.»

Mamdani has faced criticism over some of his positions taken as a young man, including supporting an academic boycott of Israel and starting a Students for Justice in Palestine chapter during his college days, as well as the past writings of his father, Mahmood Mamdani.

ZOHRAN MAMDANI FIRES BACK AT WHITE HOUSE MISPRONOUNCING HIS NAME: ‘M-A-M-D-A-N-I’

Mamdani explained his ‘radical’ background in a 2020 podcast appearance

Mahmood Mamdani’s social media presence is littered with anti-Israel positions referring to Israelis as «colonial settlers» and celebrating the idea of a «third intifada.» Additionally, Mahmood Mamdani sits on the council of an openly anti-Israel tribunal and once wrote in a book, which he dedicated to his son, that suicide bombers «stigmatized as a mark of barbarism.»

«Zohran Mamdani has built his political brand on the same radical, hate-filled and anti-American ideology his father, Mahmood Mamdani, has spent decades promoting—one that demonizes Jewish people and legitimizes anti-democratic violence,» Brooke Goldstein, a human rights attorney who specializes in antisemitism, told Fox News Digital earlier this month.

«The Jew-hatred the Mamdani family peddles is fundamentally anti-American and violates the core values our country was founded on—tolerance, equality, and liberty. Our nation’s strength lies in its diversity and commitment to protecting minority rights. Antisemitic world views threaten the peace and security of our communities.»

In the interview, the younger Mamdani went on to lament the criticism that Democratic Socialists of America have faced for supporting BDS.

MAMDANI CONFRONTED ON STREETS OF NYC ABOUT ‘COMMUNIST’ LABEL, REFUSES TO ANSWER

Democratic socialist candidate Zohran Mamdani, who won the Democratic primary for mayor of New York City, attends an endorsement event from the union DC 37 on July 15, 2025, (Spencer Platt/Getty Images)

BDS is described as «an international campaign to delegitimize the State of Israel as the expression of the Jewish people’s right to national self-determination by isolating the country economically through consumer boycotts, business and government withdrawal of investment, and legal sanctions,» according to Influence Watch.

Mamdani also explained in the interview his evolution as a «socialist.»

«I think I’ve been a socialist for quite a while, but I don’t think I understood myself within the terms of that label,» Mamdani said. «And I think that that is something that I not only internalized, but also became comfortable expressing when I became an active member of New York City DSA, which is an organization that I’ve been a member of. I attended my first meeting in early 2017, but I’ve been a much more active member since 2018.»

CLICK HERE TO GET THE FOX NEWS APP

New York mayoral candidate, State Rep. Zohran Mamdani (D-NY) stands with his mother Mira Nair, and father Mahmood Mamdani as they celebrate during an election night gathering at The Greats of Craft LIC on June 24, 2025. (Michael M. Santiago/Getty Images)

Mamdani added that he hopes to rebrand the word socialism to be more appetizing for the general public.

«I think, for me, a lot of times people try and scare you into never embracing the word, and I think that there’s a lot of work that we have to do to change our branding, because socialism in and of itself, the way I understand it, is a fight for the state to provide all that is necessary to live a dignified life for each and every person in our state,» Mamdani explained.

«That is something that when you explain it in that way, and when you talk about the way in which it is applied, when you’re talking about typically housing, healthcare, education, but I would argue we must expand that beyond and talk about public transit and talk about the internet and talk childcare. People are receptive to that.»

Fox News Digital reached out to the Mamdani campaign for comment.

INTERNACIONAL

Taiwán alertó a la UE sobre las amenazas de infiltración impulsadas por el régimen chino para socavar la democracia

El presidente de Taiwán, William Lai, advirtió este martes que su país y la Unión Europea (UE) enfrentan amenazas comunes de interferencia externa, en especial intentos de manipulación electoral, desinformación y ataques a la confianza pública.

Las declaraciones se produjeron durante una reunión con miembros de la Comisión Especial del Parlamento Europeo sobre el Escudo Europeo de la Democracia, de visita en Taipei.

“Ambos se han encontrado con interferencias informativas e infiltraciones de fuerzas externas que han intentado manipular los resultados de las elecciones democráticas, crear confrontación en la sociedad y hacer tambalear la confianza de la gente en la democracia”, afirmó Lai, según un comunicado difundido por su oficina presidencial.

El mandatario taiwanés subrayó que Taiwán y la UE comparten valores fundamentales como la libertad y la democracia, y mantienen relaciones económicas y comerciales estrechas, aunque no tienen lazos diplomáticos formales. Pese a ello, Lai señaló que existe una cooperación creciente frente a riesgos híbridos como los que —según denunció— se originan en China.

La isla ha acusado en repetidas ocasiones a Beijing de desplegar campañas de desinformación, operaciones de influencia y ciberataques con el objetivo de socavar su sistema político. Lai reiteró que Taiwán rechaza las reclamaciones de soberanía de China, país que considera a la isla parte de su territorio y ha intensificado su presión diplomática y militar en los últimos años.

“Taiwán está decidido a trabajar para salvaguardar la democracia, la paz y la prosperidad en todo el mundo, y espera compartir su experiencia con Europa”, añadió el presidente taiwanés, al tiempo que agradeció el respaldo expresado por instituciones europeas ante las amenazas sobre el Estrecho.

En paralelo a la visita de la delegación europea, el Ministerio de Relaciones Exteriores de Taiwán (MOFA) valoró como “sincero y significativo” el apoyo expresado por Bruselas. El pronunciamiento del MOFA fue en respuesta a las conclusiones del 13.º Diálogo Estratégico UE-China, celebrado el 2 de julio en Bruselas y copresidido por la vicepresidenta de la Comisión Europea, Kaja Kallas.

Durante ese encuentro, la diplomática europea reiteró su rechazo a cualquier intento unilateral de modificar el statu quo en el Estrecho de Taiwán, en especial a través de fuerza militar o coerción, según el comunicado oficial. Kallas también manifestó preocupación por la situación de los derechos humanos en China y por las amenazas híbridas provenientes de Beijing, que afectan tanto a Europa como a la región del Indopacífico.

Además, el MOFA recordó que el Servicio Europeo de Acción Exterior (SEAE) ha emitido varios comunicados en respuesta a tres ejercicios militares a gran escala realizados por China desde mayo, los cuales incluyeron simulacros de bloqueo marítimo y ataques coordinados alrededor de la isla. Esos comunicados subrayaron la importancia de mantener la paz y la estabilidad en el Estrecho como elemento clave para la seguridad regional y global.

“La UE tiene un interés directo en mantener el statu quo en el Estrecho de Taiwán”, afirmó el MOFA en su declaración. El ministerio también aseguró que Taiwán continuará fortaleciendo la cooperación con Bruselas y otros aliados democráticos para proteger el orden internacional basado en normas, y para enfrentar las amenazas comunes que afectan a regímenes democráticos.

China ha rechazado todas las acusaciones de interferencia y sostiene que Taiwán busca apoyo extranjero para impulsar una agenda separatista. A pesar de ello, tanto Taiwán como la UE han intensificado en los últimos años los canales de comunicación informal, especialmente en áreas de comercio, tecnología, ciberseguridad y defensa de los valores democráticos.

(Con información de Reuters)

Asia / Pacific,TAIPEI

POLITICA3 días ago

POLITICA3 días agoJuan Carlos Maqueda defendió la condena contra Cristina Kirchner: “Hay una sensación de que se hizo Justicia y que no hay impunidad”

POLITICA2 días ago

POLITICA2 días agoExpulsada del Gobierno, Victoria Villarruel empieza a tomar distancia, pero no tiene proyecto político para este año

POLITICA2 días ago

POLITICA2 días agoLa CGT evalúa adelantar a octubre el recambio de sus autoridades y define una movilización contra Milei